Note -- Fed balance sheet

TL;DR: I had some questions around inflation rate and interest rate recently. Did some reading around Fed balance sheet, note here.

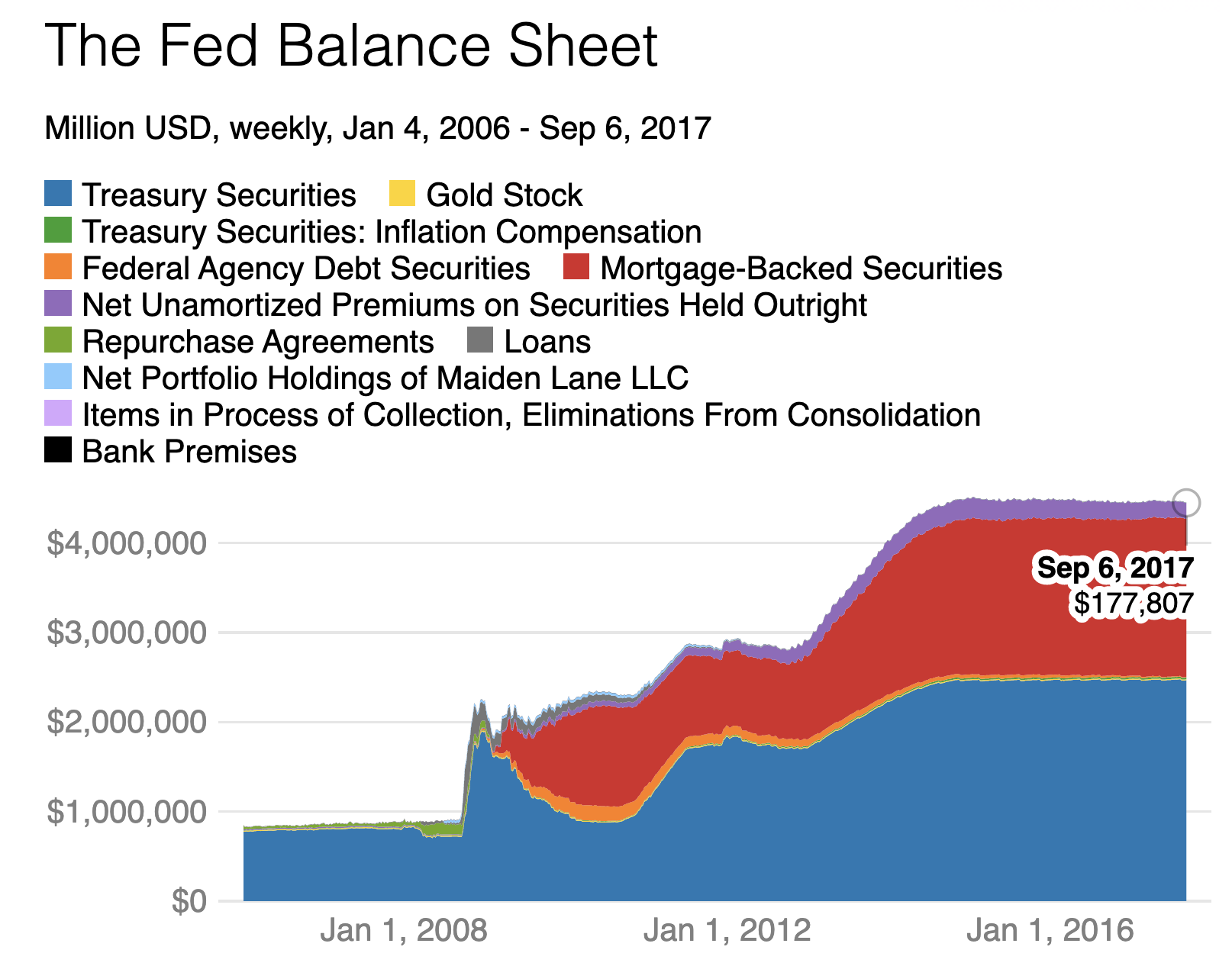

Fed’s balance sheet consists of assets and liabilities.

Fed’s assets

Anything, for which the fed has to pay money, becomes the fed’s asset.

Traditionally, the Fed’s assets have mainly consisted of government securities and loans extended to member banks through the repo and discount window. When the Fed buys government securities or extends loans through its discount window, it simply pays by crediting the reserve account of the member banks through an accounting or book entry. In case member banks wish to convert their reserve balances into hard cash, the Fed provides them dollar bills.

Notes

- Fed buys assets -> balance sheet expansion

- Fed sells assets -> balance sheet contraction

- No limit for expansion

- Has a limit for contraction. The limit is determined by the value of assets

- Fed buys assets -> intends to increase the money supply -> reduce interest rate

- Fed sells assets -> intends to decrease the money supply -> increase interest rate

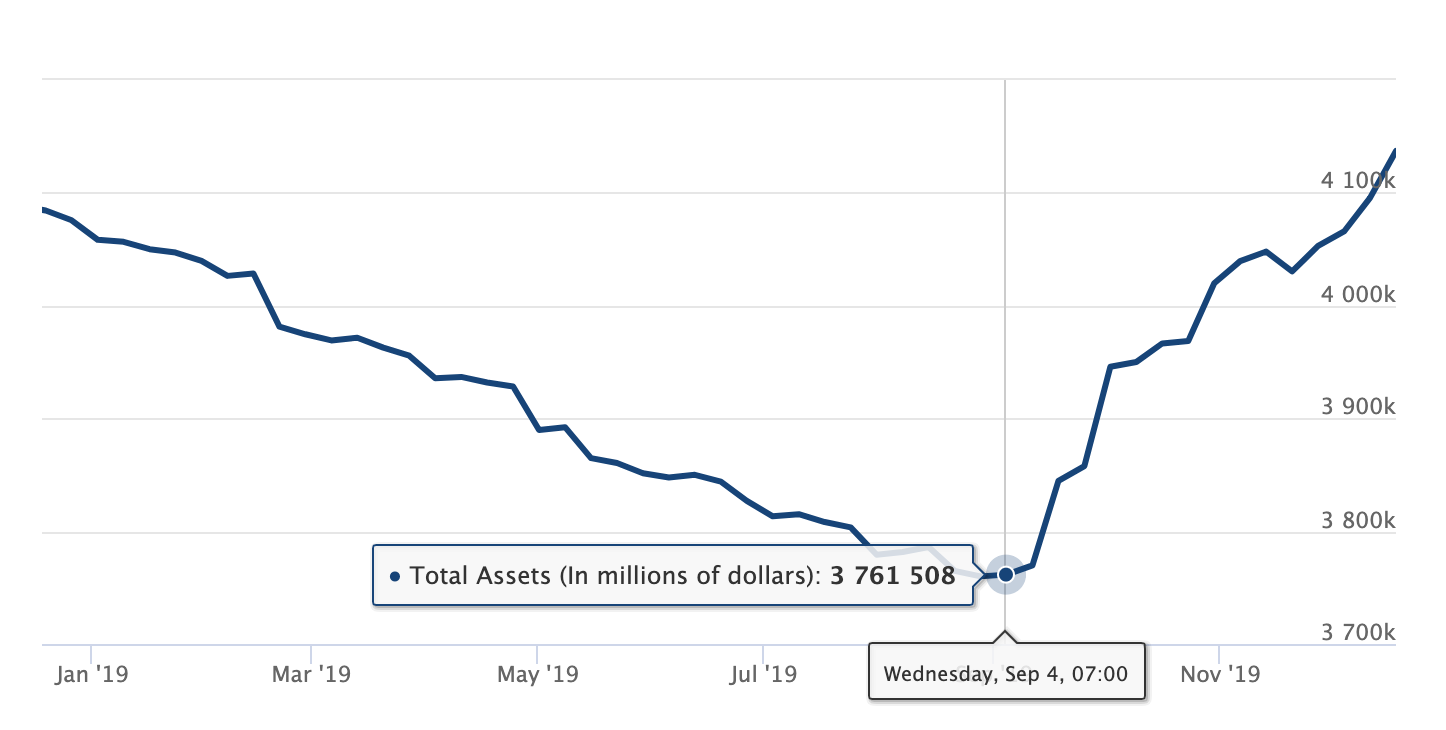

- 858B on 8/1 2007, 2.24T 2016, 4.45T 2019

Recent trend

Clearly, Fed is expanding at 3x speed compared with first 9 months’ contraction early this year.

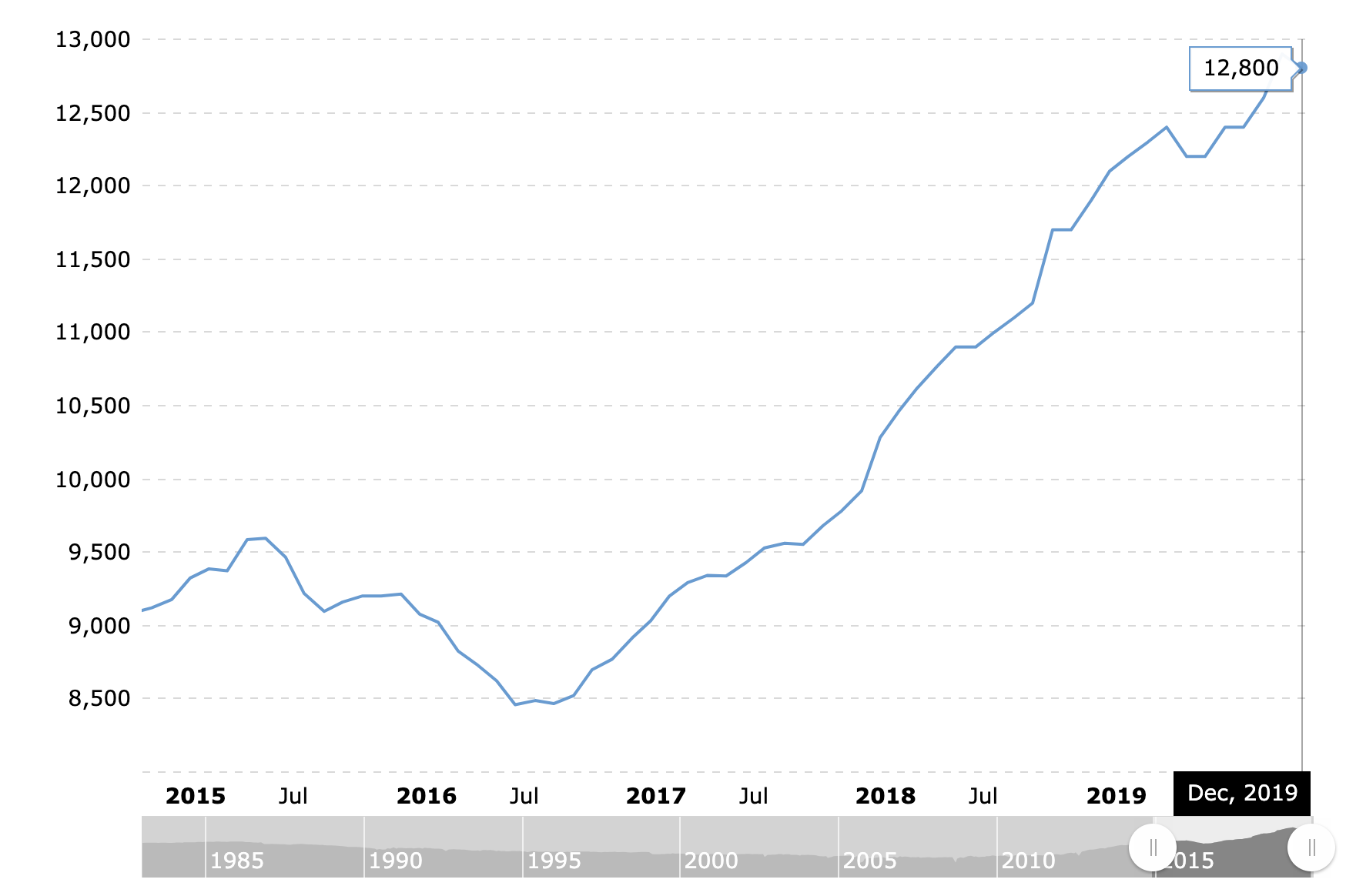

CPI vs Unemployment rate (Phillips Curve)

We are in a historical low unemployment period. Based on Phillips curve, our price inflation should be high. But the reality is we are experiencing low unemployment and low CPI

My hypothesis about low CPI

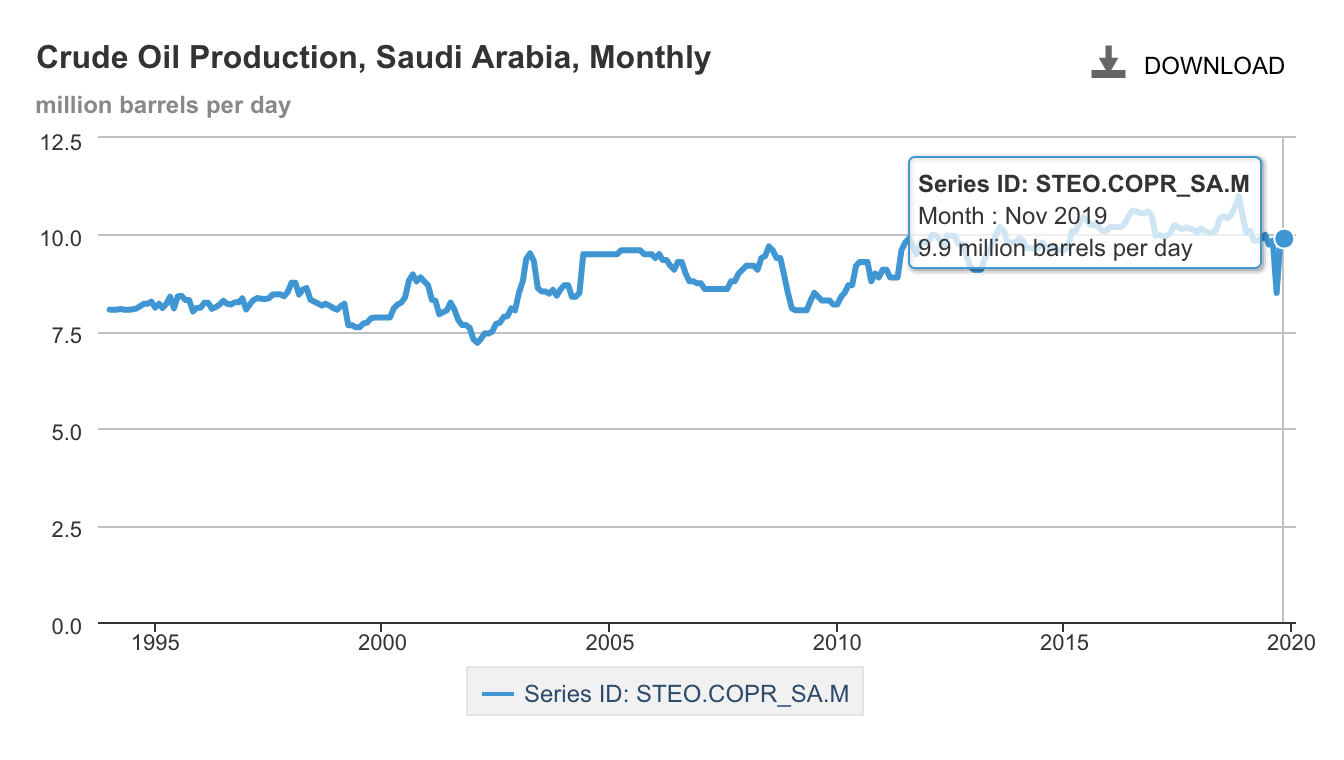

US becomes pure oil supplier, which is driving down energy price.

- US produces at ~13 million barrels per day

- Saudi Arabia produces at ~10 million barrels per day.

- (是的,我上半年看到这个trend都惊呆了,颠覆我的认知,所以世界是变化的,人的mindset也得跟上)

Increased money supply went to automation investment, which further improve production efficiency => driving down cost

A lot of money circulated into technology industry, tooling and infra got significant investment. Theoretically, it will reduce the cost of goods/services.

Implication to the market (my hypothesis)

- More money supply from investors’ perspective -> Bull market

- More money supply from consumer + low CPI -> more transactions -> corporate revenue increase -> good earnings

- More money supply from coporate perspective -> coporate can borrow money at lower rate to invest -> really depends on how risk portolio at aggregated level…

- With #3, bubble …