Note -- German Debt Crisis and Hyperinflation

TL;DR: Reading notes for German Debt Crisist (1918 - 1924)

Background

- Gold standard with fixed rate conversoin

- War started

- People exchanged money for gold

- Gold supply was short causing money supply shortage

- Suspended the fixed conversion on 7/31 1914

- Buy short-term treasury bills + commercial bills as collateral for money printing

- Within 1 month, the quantity of notes increased by 30%

Phase 1: Printing money for funding war

Logical chain:

(A) the amount of money in circulation is much greater than the amount of gold (B) Investors are rushing to convert money into gold

=> Only 2 choices:

(A) Tightening credit (cutting money supply) (B) Ending convertibility and printing more money. Most cases, central bank will choose B

Fighting war required Government to significantly increase expenditures. 2 Ways to do that: (A) Raising new revenues (taxiation) (B) Increasing government borrowing (government debt) => The war had to be financed by issuing domestic debt

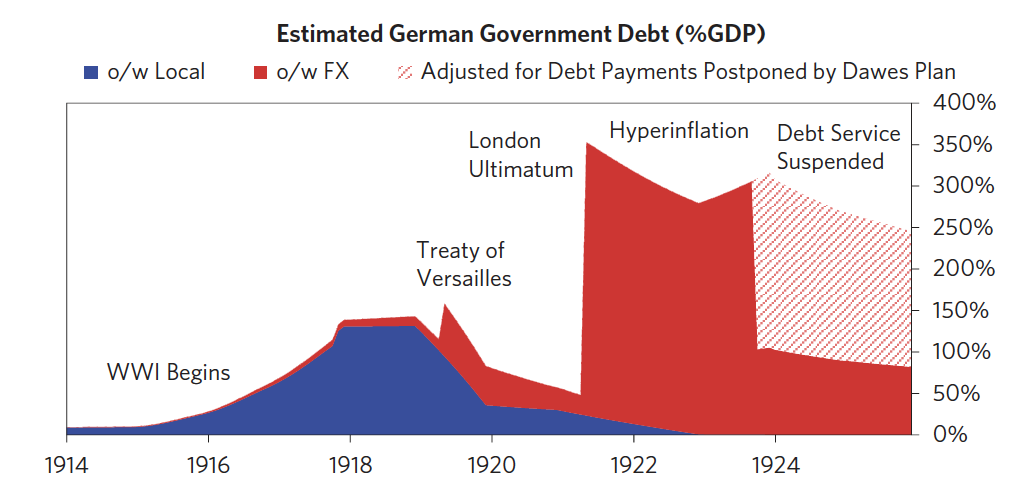

1914 -> 1918 Germany had local currency debt stock of 100B = 130% of German GDP “The greatest weakness in the war financing of the enemies is their growing indebtedness abroad [particularly to the US], “

Public got more reluctant to purchase government debt over time. But war needs to be funded. German government began borrowing in foreign currencies because lenders were unwilling to take promises to pay in marks.

Unlike local currency debt, hard currency (foreign currency and gold denominated) debt cannot be printed away

The hope was that once Germany won the war, the mark would appreciate, making those debt burdens more manageable.

BUT, this was typical war time strategy to raise money/printing money at the time.

Metrics to look at

- No Reserve currency

- Low foreign exchange reserve

- % of foreign denominated debt

- A large and increasing budget and/or current account deficit

- Negative real interest rates

- Have a history of high inflation

Phase 2: Capital flight out further drove down the FX rate, increase inflation

War ended and Germany lost -> Treaty of Versailles -> Germain citizens rushing to get their capital out of the country to fear high taxes and confiscate private wealth

Debtors also rushed to pay off as many of their foreign debts as they could due to mark FX rate fell

Phase 3: Government led inflation to “naturally” reduce the real debt

Germany faced the classic dilemma: whether to help those who are long the currency (i.e., creditors who hold debt denominated in it) or those who are short it (i.e., debtors who owe it). In economic crises, policies to redistribute wealth from “haves” to “have-nots” are more likely to occur. This is because the conditions of the “have-nots” become intolerable and also because there are more “have-nots” than “haves.”

Although levels of activity remained very depressed, by late 1919/early 1920 Germany had inflated away most of its domestic debt, passed a comprehensive tax-reform package to generate new revenues, and was beginning to see a pickup in economic activity.

Phase 4: International situation tightening causing relative stabilization 03/1920 to 05/1921

Rising economic activity and reflationary policies did not result in much inflation in Germany between March 1920 and May 1921, as domestic inflationary pressures were being offset by global deflationary forces. Import prices from the US and UK fell by about 50 percent, and rising capital flows into the outperforming German economy helped to stabilize the currency, which allowed for slower growth in the money supply

Phase 5: London ultimatum 05/1921

The reparation schedule created a balance of payments crisis. In many ways, a balance of payments crisis is just like any other serious problem faced by individuals, households, and corporations in making a payment. To come up with the money, a country must either 1) spend less, 2) earn more, 3) finance the payments through borrowing and/or tapping into savings, or 4) default on the debt (or convince creditors to give it relief)